XRP Price Prediction: Technical Pressure Meets Strong Fundamentals

#XRP

- Technical Positioning: XRP testing crucial support at $2.20 with bearish MACD but potential stabilization signals

- Fundamental Strength: Ripple's $500M funding round and $40B valuation demonstrate strong institutional backing

- Catalyst Potential: Growing ETF applications and corporate hedging use cases could drive significant price appreciation

XRP Price Prediction

XRP Technical Analysis: Key Support Test Amid Bearish Signals

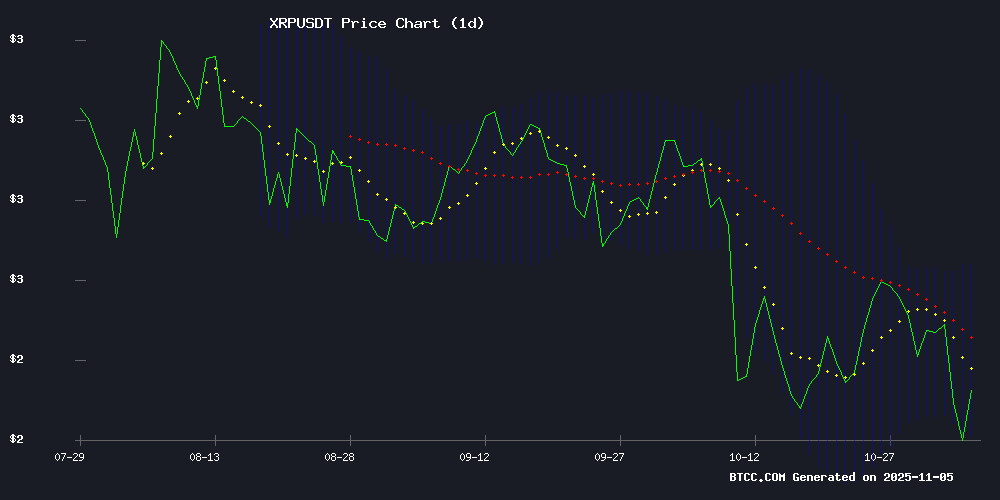

According to BTCC financial analyst Olivia, XRP is currently trading at $2.2526, below its 20-day moving average of $2.4504, indicating short-term bearish pressure. The MACD reading of -0.0350 shows negative momentum, though the histogram at -0.0340 suggests potential stabilization. XRP is trading NEAR the lower Bollinger Band of $2.2009, which may act as crucial support. A break below this level could trigger further declines toward $2.00, while holding above it might lead to a retest of the middle band at $2.4504.

XRP Fundamentals Strengthen Despite Market Pressure

BTCC financial analyst Olivia notes that Ripple's recent $500 million funding round at a $40 billion valuation demonstrates strong institutional confidence. The growing interest from major financial players like Citi, Franklin Templeton, and Canary Capital in XRP ETFs and corporate hedging applications provides substantial fundamental support. However, Olivia cautions that while these developments are positive, current technical weakness and market-wide altcoin pressure may delay significant price appreciation until broader market sentiment improves.

Factors Influencing XRP's Price

Ripple Closes $500M Strategic Funding Round at Swell 2025, Valuation Reaches $40B

Ripple has secured $500 million in fresh funding during its Swell 2025 event, catapulting its valuation to $40 billion. The investment round was spearheaded by prominent financial institutions, including affiliates of Pantera Capital, Fortress Investment Group, Citadel Securities, Brevan Howard, Galaxy Digital, and Marshall Wace.

The deal underscores growing institutional confidence in Ripple's blockchain solutions for cross-border payments. Market observers note the funding could accelerate the company's expansion into new regulatory jurisdictions and product verticals.

Citi's Ryan Rugg Advocates TradFi-DeFi Merger with Ripple at the Core

Ryan Rugg, Citi's Global Head of Digital Assets, emphasized the necessity of merging traditional finance (TradFi) and decentralized finance (DeFi) to achieve enterprise-scale adoption during her speech at Ripple Swell. Ripple is positioned as a pivotal player in this convergence, bridging the gap between the two sectors.

Rugg dismissed the media's portrayal of TradFi and DeFi as competitors, asserting collaboration is essential. Citi's Token Services, now operational in the U.S., U.K., Hong Kong, and Singapore, underscore this shift, focusing on real-time liquidity and 24/7 cross-border payments.

XRP Price Forecast: Corporate Hedging Potential Could Propel Market Cap

Corporate treasuries are increasingly eyeing XRP as a novel instrument for foreign exchange risk management. While traditional hedging tools like forwards and swaps dominate current strategies, the digital asset's subsecond settlement times and negligible transaction costs present a compelling case for cross-border efficiency.

Nearly half of global firms now hedge currency exposure, with European and North American corporations leading adoption at 86% and 82% respectively. Unhedged enterprises suffered measurable losses in three-quarters of cases this year, driving demand for innovative solutions.

XRP's volatility remains elevated compared to fiat currencies, limiting its immediate utility as a hedge. Yet treasury departments are testing allocations to digital assets for operational efficiency, with XRP's liquidity and established payment infrastructure making it a prime candidate.

Ripple CEO Brad Garlinghouse Headlines Swell 2025 with Keynote on Blockchain's Financial Future

Ripple's flagship Swell 2025 conference has become the epicenter of crypto-finance convergence, with CEO Brad Garlinghouse taking center stage alongside U.S. digital asset advisor Patrick Witt. The event showcases unprecedented alignment between institutional finance and blockchain innovation, as evidenced by Nasdaq CEO Adena Friedman's participation.

Monica Long, Ripple's President, set the tone by declaring a "new era of economic progress through digital assets" during her opening remarks. Industry heavyweights including Bitwise's Hunter Horsley reinforced the narrative of traditional and crypto markets achieving structural integration. Market observers await Garlinghouse's anticipated revelations about Ripple's role in shaping global payment infrastructure.

Finance Coach Views XRP Under $2 as Opportunity Amid Market Turbulence

Market volatility has dragged XRP below the critical $2.50 level, but financial analyst Coach JV interprets the sub-$2 pricing as a strategic buying opportunity. The token's current weakness contrasts with his long-term bullish outlook.

Bearish pressure continues to mount, with XRP testing support levels not seen since early 2023. Technical indicators suggest the $2 psychological barrier may face repeated tests before establishing a durable bottom.

Franklin Templeton, Bitwise, and Canary Capital Advance U.S. Spot XRP ETF Filings

Franklin Templeton, Bitwise, and Canary Capital have submitted revised S-1 registrations for spot XRP ETFs, signaling potential mid-November launches. The filings mark a critical step toward regulatory approval and could catalyze institutional demand for XRP.

Market participants anticipate heightened trading activity around XRP as ETF prospects solidify. The cryptocurrency's price trajectory may reflect growing confidence in its regulatory clarity and institutional adoption.

Canary Capital CEO Positions XRP as Wall Street Competitor at Ripple Swell Conference

Steven McClurg, CEO of Canary Capital, delivered a robust endorsement of XRP's long-term viability in global finance during the Ripple Swell conference. He framed the XRP Ledger (XRPL) as a burgeoning challenger to traditional Wall Street infrastructure, signaling a shift in the competitive landscape of financial rails.

McClurg's remarks underscore the growing institutional recognition of blockchain-based solutions. The XRPL's efficiency in cross-border transactions and asset settlement positions it as a viable alternative to legacy systems, particularly in high-volume institutional environments.

Impact on XRP Price If Corporate Treasuries Use It for FX Hedging

Corporate treasuries exploring XRP for foreign exchange hedging could significantly alter the token's market dynamics. As FX risk management grows increasingly critical for multinational firms, the digital asset's utility in cross-border transactions may drive renewed institutional interest.

XRP's price historically reacts to adoption news, with potential upside from treasury demand creating a new buy-side pressure. Liquidity improvements across major exchanges would likely follow any meaningful corporate adoption, though regulatory clarity remains a key gating factor.

XRPL Was Not Built to Make XRP Price Go Up: Ripple CTO

Ripple's Chief Technology Officer, David Schwartz, has clarified that the XRP Ledger (XRPL) was designed primarily to facilitate efficient payments rather than to drive the price of XRP. The statement came during a community debate sparked by the recent Balancer hack, which evolved into a broader discussion about the XRPL's underlying philosophy.

Schwartz's remarks underscore Ripple's focus on utility over speculative value. The XRPL's architecture prioritizes speed, cost-effectiveness, and scalability for cross-border transactions—a vision distinct from token price appreciation.

Bloomberg Analyst Predicts Timeline for Franklin XRP ETF Launch

The race to launch the first wave of U.S. spot XRP ETFs is intensifying, with new timelines for debut emerging. Market participants are closely monitoring developments as institutional interest in digital assets continues to grow.

Franklin Templeton's potential entry into the XRP ETF space signals broader acceptance of cryptocurrencies in traditional finance. Analysts suggest this could pave the way for further crypto-based financial products.

XRP Tests Key Support Amid Market-Wide Altcoin Pressure

XRP faces a critical test at the $2 support level as bearish momentum builds across altcoin markets. The token trades at $2.31 with 1.73% daily losses, while maintaining its top-five market cap position at $139 billion. Trading volume remains robust at $7.91 billion despite the pullback.

Technical indicators paint a cautious picture, with resistance firming at $2.30 and the Relative Strength Index signaling bearish territory below the 50 median. A decisive break below $2.23 support could trigger further downside, while bulls eye $2.35 as the next upside target.

The Madras High Court's recognition of XRP as legal property adds a fundamental counterpoint to the technical weakness. Market participants now watch whether institutional validation can offset the current selling pressure.

How High Will XRP Price Go?

Based on current technical indicators and fundamental developments, BTCC financial analyst Olivia provides this XRP price outlook:

| Timeframe | Price Target | Key Factors |

|---|---|---|

| Short-term (1-4 weeks) | $2.00 - $2.45 | Bollinger Band support, MACD momentum, market sentiment |

| Medium-term (1-6 months) | $2.80 - $3.50 | ETF approval progress, corporate adoption, Ripple developments |

| Long-term (6+ months) | $4.00+ | Institutional adoption, regulatory clarity, market cycle |

Olivia emphasizes that while current technicals show weakness, the strong fundamental backdrop from Ripple's recent $500 million funding and growing institutional interest provides solid foundation for future growth. The key resistance levels to watch are $2.45 (20-day MA) and $2.70 (upper Bollinger Band), with critical support at $2.20.